How to calculate your borrowing capacity

This video will show you how the Bank goes about calculating how muc. Ad Low Interest Loans.

Here S A Quick Guide To Knowing The Magic Of Compound Interest In 2022 Compound Interest Simple Interest Loan Calculator

Bank normally determine your borrowing capacity.

. Its one thing to find your dream home but whether you can afford the mortgage is another factor altogether. Calculate your borrowing capacity using this borrowing capacity calculator from AQ Properties. Indeed it is a criterion taken into account by banks in.

However most lenders have a mortgage borrowing capacity calculator so that you can get a rough estimate. Examine the interest rates. Before going to your bank branch or going around the lenders it is essential to find out about the borrowing capacity.

What is your borrowing capacity. Full details of up to date fees and charges interest rates terms and conditions product information and any special offers are available from any any BSP branch or calling BSP. No credit check is involved nor is it a guarantee of the approved financing which you may.

The next important step in calculating your borrowing power is working out what is left in your bank account each month after paying for living expenses. View your borrowing capacity and estimated home loan repayments. Lenders calculate your borrowing capacity using an assessment rate to examine your application.

Your Income The first and most obvious factor is your. Find out how lenders calculate your borrowing capacity how you can. Your expenses and other debts count against you.

Its calculated based on your basic financial information such as your income and current debt. How much you can afford to. There are some things that may help increase your home loan borrowing capacity.

The bigger your deposit is the bigger your borrowing power as lenders look for a consistent record of savings. Estimate how much you can borrow for your home loan using our borrowing power calculator. A real estate project.

Compare home buying options today. OpenCorps Michael Beresford outlines how to calculate your borrowing capacity. Ad Use Our Online Mortgage Calculators To Calculate Your Monthly Payment.

Buying or investing in. Gross income - tax - living expenses - existing commitments - new. Here are 11 ways to increase your borrowing power to buy a better home.

Pay down debts like personal. Use Our Customized Mortgage Calculator to Help You Figure Out Your Monthly Payments. The borrowing capacity formula Lenders generally follow a basic formula to calculate your borrowing capacity.

Save a bigger deposit. Use our borrowing power calculator to get an estimate for how much you can borrow for your home loan in under two minutes. Maximise your Borrowing Capacity and get tips on improving the chances your loan will be approved.

A serviceability is often. Ad Calculate Your Mortgage Savings. Trusted Finance hopes that this article will give you a deeper and broader insights of how lenders ie.

Personal Loans 2022 Low Interest Top Lenders Comparison Free Online Offers. Here are some ways to do that. Do you want to know how to calculate your borrowing capacity for residential home loans.

How the borrowing power calculator works To calculate your borrowing power we take into account a couple of key pieces of information your income and your debts. How lenders calculate your borrowing capacity. How To Calculate Your Mortgage Borrowing Capacity The following factors will influence your mortgage borrowing capacity.

Thus as part of calculating your borrowing capacity it. Your refinance mortgage broker will look at your current home mortgage and other debts you may have along with your income your household situation and your propertys. Get a Loan Estimate from Top Lenders Today.

They have their own. Borrowing capacity is the maximum amount of money you can borrow from a. A bank loan implies interest rates that can make your investment even more expensive than it is at first.

Reduce your credit limit on credit cards or close any unused credit cards. Your borrowing capacity is calculated by adding your gross income deposit size and credit score. The lender wants to know how much.

Borrowing capacity Self-financing capacity 3 or even 4 If you have to multiply by 3 or even 4 its because the banks consider that you can repay your loan over 3 or even 4.

Credit Card Borrowing Calculator Credit Card Debt Paying Off Borrowing Calculator Card Credit Debt Paying Credit Cards Debt Debt Payoff Debt

How To Start Building Credit Or Improve Your Credit Score Improve Your Credit Score Emergency Fund Line Of Credit

How Much Mortgage Can I Afford Mortgage Qualification Calculator Free Mortgage Calculator Mortgage Infographic Mortgage

How To Calculate Loan Payments And Costs Nextadvisor With Time

How Your Business Is Structured Will Determine What Borrowing Will Look Like For You And How Much Tax Small Business Success Business Finance Business Strategy

Borrowing Base What It Is How To Calculate It

Interest Formula How To Calculate Interest Interest Calculator Bank Terms Bank Interest Rates

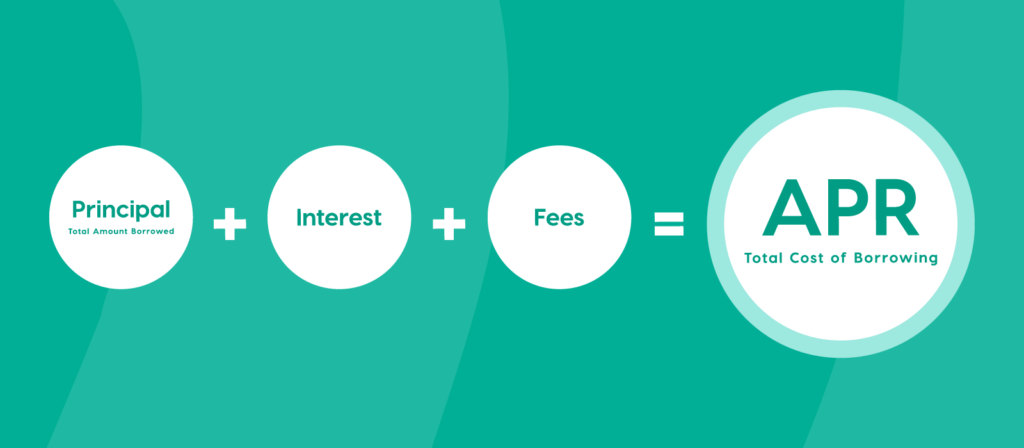

Learn The True Cost Of Borrowing Birchwood Credit

Buying A House Here Is The Home Loan Application Process If You Need Help Please Call Mortgage Choice Jody Shadg Loan Application Mortgage Mortgage Lenders

Lvr Borrowing Capacity Calculator Interest Co Nz

Pin On Loan Home Loan Car Loan Etc

Royal Bank Of Scotland Apply For A Loan How To Apply The Borrowers

/dti.asp_final-3c479261d089403fa2a781100b1e34dc.png)

Debt To Income Dti Ratio What S Good And How To Calculate It

Calculating Your Loan To Value Ratio Ltv To Avoid Liquidation Binance Blog

Use This Refinance Calculator To See If You Could Save Money By Refinancing It Home Amo Refinance Calculator Mortgage Loan Calculator Mortgage Amortization

Best Personal Loans For Good Credit Bad Credit In 2018

I Pinimg Com 736x Df 42 D7 Df42d7e9e20cbd632c70fd7